While there have been many online peer to peer lending opportunities open to US citizens, such as Prosper and Lending Club, lending options in Canada have been non-existent in Canada until October 2016, when Lending Loop received regulatory approval to offer its platform in Canada. Lending Loop is now making loans to dozens of Canadian businesses, and has over 10,000 investors.

I'd like to share my current result with the platform, and my impressions thus far.

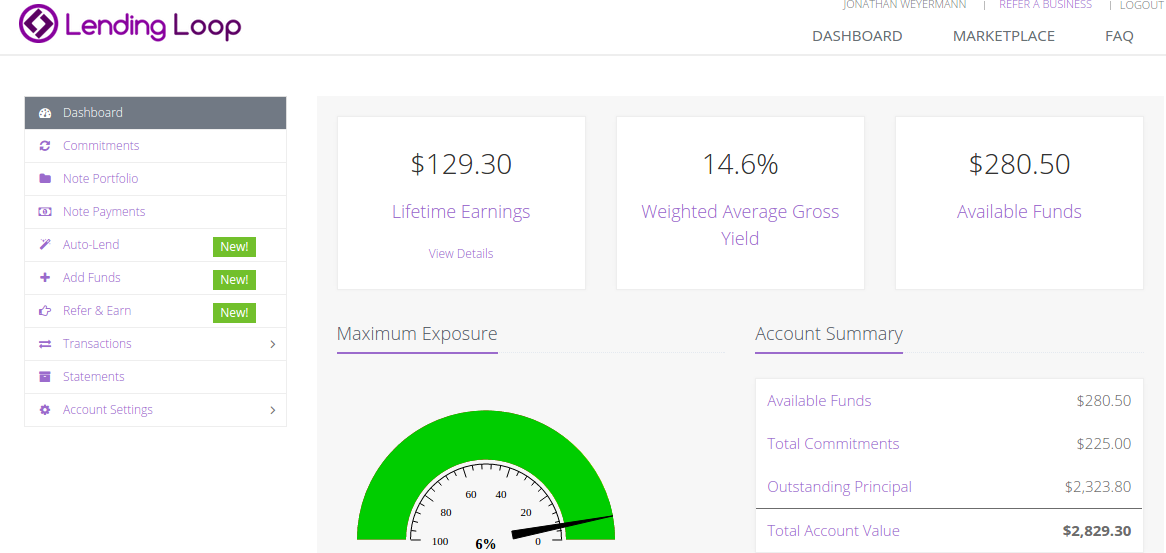

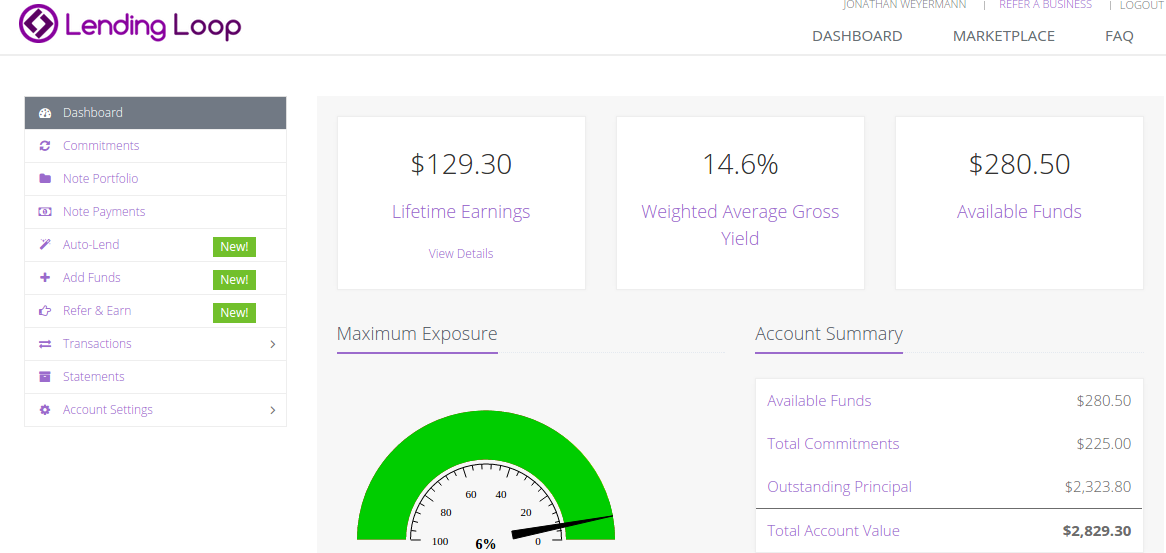

As you can see from the screen shot above, I'm currently up $129 with a total investment of around $2900. I've made the contributions very slowly over the last year. For most of the businesses I have only invested $25(the minimum), though when I made my Initial $1000 deposit, there were few businesses, so I allocated $150-$200 to some of the early ones. There is one business which has been delinquent as of late, meaning the payments are not made on time, but I suspect they will catch up eventually. However, I can't expect my return to actually 14%, as some loans will inevitability be defaulted on.

The loans range in various lengths, most between 18 months to 4 years, and get paid back every month in chunks, part interest, part principal. Thus, in order to make the full return expected, one must continually reinvest the proceeds. This doesn't bother me though, as the returned capital allows more diversification and reduces risk. However, you will never make the full returns if you don't reinvest your principal.

Unlike mutual funds and other stock market investments, lending loop does not support RRSP and TFSA at this point, which means that all your gains will be unfortunately taxed at your marginal tax rate. An investment like this would greatly benefit from TFSA, because interest doesn't count as capital gains, and is thus fully taxes. Lending loop hopes to eventually offer TFSA and RRSP's however.

Lending Loop has recently added auto-deposit and auto-invest, allowing you to automatically deposit funds at regular intervals, and automatically invest predetermined amounts (in multiples of $25) in either low risk (6-9%) or high risk (10-25%) . I've chosen to automatically invest $25 in all high risk opportunities, and try to match my contribution interval to not have too much money in the account. Once the contribution windows gets too long (ie 4 weeks or more), I'll up investment amount to $50 per investment. Its good to have some spare money sitting in the account, as some loan requirements are satisfied almost immediately

If you'd like to invest with Lending Loop, please use my referral link https://www.lendingloop.ca/?code=0e40f4

I'll try to post updates of my progress at regular intervals

----------------------------

Update January 18th, 2018

1) Earnings are at $259.29

2) weighted average gross yield is at 16.3%

3) Total account value is $4759

Other thoughts

I've changed my investment profile to include B rated (12.2%) investments and everything riskier.

The one business which was habitually late has defaulted and is in collection, with $134 outstanding from me, and it's been in that state quite a while already.

It's difficult to predict how much money you need to add to participate in all of the investments that fit your profile, as they can come in somewhat irregularly. Deposits take 4 days at least, and high interest loans can sometimes be filled rather quickly. This makes it easily possible to miss some of the loans you may wish to participate in, and requires a significant cash float in the account to mitigate.

Posted by Jonathan Weyermann on December 6, 2019 at 12:12 AM

Posted by Jonathan Weyermann on December 6, 2019 at 12:12 AM

0 Comments

Add Comment