Swiss borg is "the first wealth management platform for cryptos based on the blockchain, made in Switzerland by a team of financial experts". Swissborg aims to take cryptocurrency from the exchange into the investment portfolio. Their aim is to disrupt the traditional investment industry as well, with the tokenization of assets and token based voting.

Swissborg's first aim is to introduce a number of token tracking tokens, or index token. These would be considered safer investments than traditional altcoins, as the risk is spread out among many different tokens. The there i'm aware of are

The Cryptallion - a multi strategy Fund, it will combine multiple strategies (trend following, ICO, lending, etc) in one token, while the other two are single strategy funds. Cryptallion expects to have a much better risk/return profile due to the diversification of strategies.

Astronaut - an ICO only focused fund, with a discount structure. (a discount structure in a Fund, which is highly problematic)

Crypto20 - a passive strategy fund

Then they intend to launch is an off-chain crypto fund. Currently the only cryptocurrency fund seem to be Bitcoin related. This fund seems like an etf holding various cryptocurrencies trading over an exchange. Such a product does not yet exist, but a big hurdle to these kind of funds seems to be regulatory approval. If any kind of off-chain cryptocurrency fund trading over an exchange could be made, it would be monumental step forward for the widespread adoption of cryptocurrency investing. This would be a safer investment choice because it presumably would be traded like a financial instrument and couldn't be hacked like a traditional cryptocurrency.

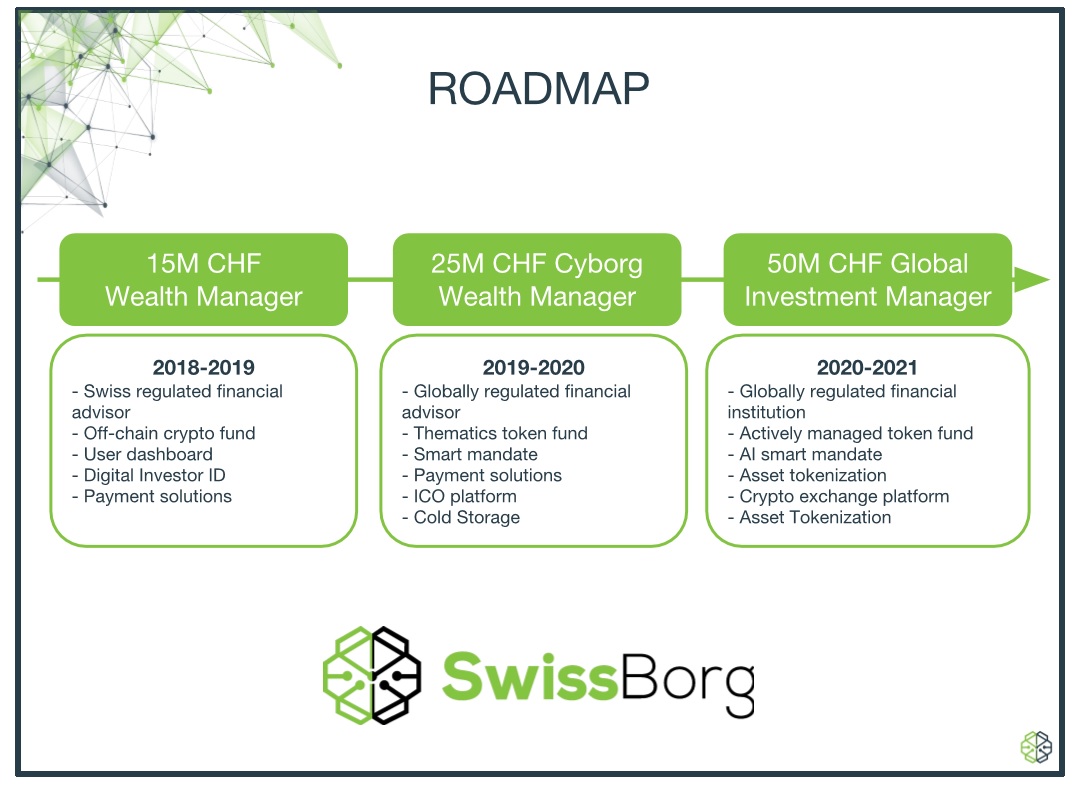

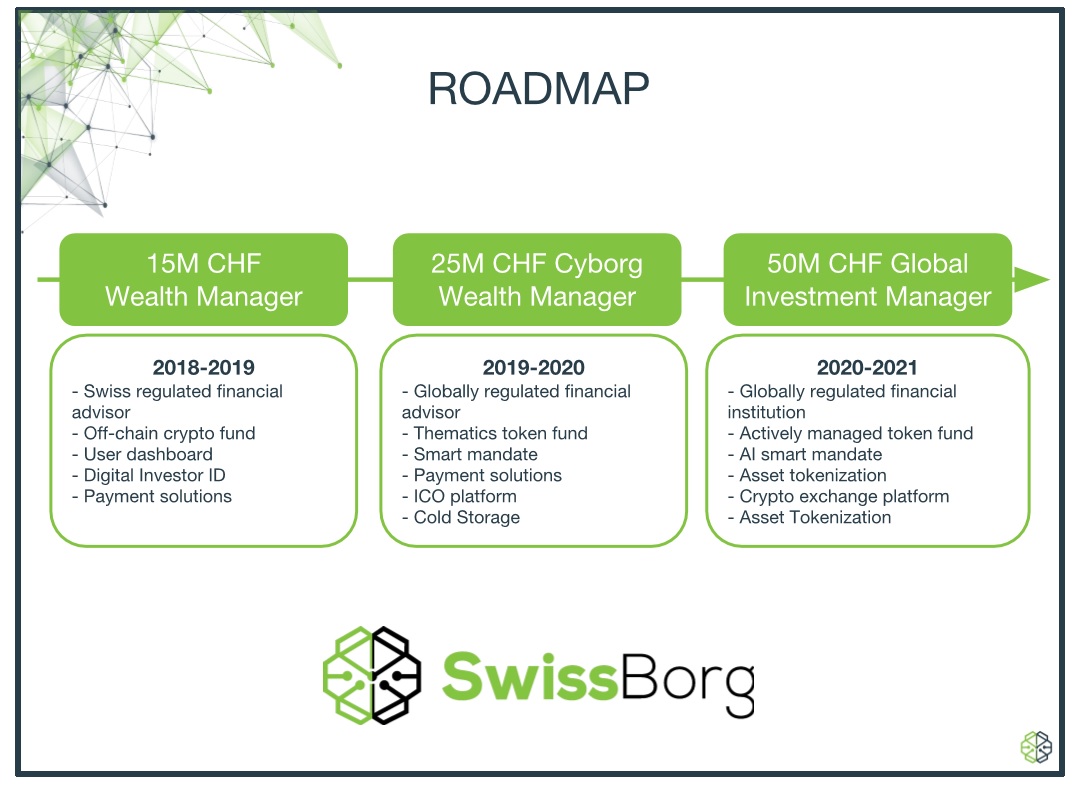

Between 2019 and 2020, Swissborg intends to provide an ICO platform for investment into cryptocurrency startups and cold storage to secure tokens. They intend to become a globally regulated financial adviser in that time as well.

By 2020 or 2021, they expect to support asset tokenization. This would allow financial assets such as stocks or real estate to be tokenized and traded piece-wise, probably with minimal fees. It would allow extreme customization in investment choice, and would especially help with the fractional purchases of expensive shares, such as AMZN. They also expect to have their own cryptocurrency exchange platform up and running, though by that time that won't be anything too exciting, unless it's combined well with some of their other offerings.

The CHSB token is currently trading for less than half ICO price, so it may be a good time to get some, though please remember that this is a startup, and thus this is a highly specutive investment. Don't invest what you cant afford to lose.

Update for February 2021:

I'm using the swissborg app to manage my cryptocurrentcy.

The swissborg app allows trading of various cryptocurrencies, including BTC, ETH, BNB, USDC(pays a yield) and the swissborg token CHSB. This is a utility token that pays a yield and is periodically bought back and destroyed by the company (like a share buyback). Holding a large number of these affords privileges such as higher yield and lowered exchange costs.

Check back soon for an explanation of how I've allocated my portfolio. If you want to sign up with them, please use my referral link at https://join.swissborg.com/r/jonathL3HI

Posted by Jonathan Weyermann on December 6, 2019 at 12:12 AM

Posted by Jonathan Weyermann on December 6, 2019 at 12:12 AM

0 Comments

Add Comment